At Aye, we’ve been seeking to change the paradigm of MSME financing in India. Our objective was to turn it from a time-consuming and expensive procedure into a productive and profitable venture.

The first step toward this approach was taken in 2014 when we offered the first loan to a micro business in West Delhi’s footwear manufacturing industry. We now address the financial requirements of more than 100 clusters, not only in the manufacturing sector but also in the service and trading industries. With centres in 312 cities, Aye has helped over 3,50,000 micro businesses get access to credit.

Our phygital model and cluster-based credit evaluation technique overcome the barrier between MSMEs and organised lending practices. Aye Finance has had constant success thanks to the effective application of this hybrid technique.

Setting Ourselves Apart

- We distinguish ourselves from others by developing a technically advanced approach for generating credit analytics from a range of available business and behavioural data.

- This efficient credit evaluation, along with modernised workflow automation and a small but committed workforce, connects the dots between MSMEs and structured financing.

- The cloud computing architecture allows for easy customer service delivery at a low cost. It is part of our aim to use innovative techniques to achieve workforce productivity, detect fraud early, and eliminate unnecessary risks.

- Aye Finance has been a pioneer in creating AI and machine learning models to help MSME businesses get affordable credit. It has used sophisticated AI/ML solutions in many of its core business operations.

- Our algorithms forecast crucial consumer behaviour at a micro level, which has helped us enhance our credit selections, increase efficiency in our consumer acquisition and recovery procedures, and provide personalised solutions and up-sell proposals to our key demographic category.

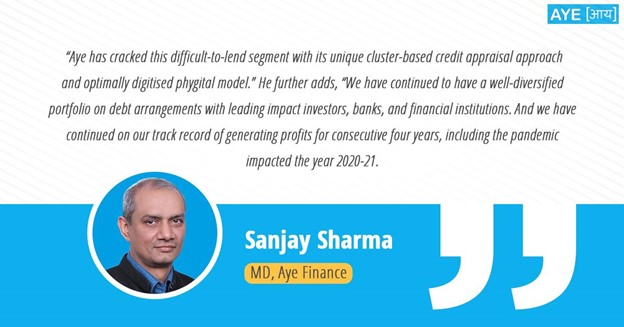

A Word from our MD

We do not want to be remembered just for what we have accomplished but also for how we have achieved it. Our fundamental principles of innovation, trustworthiness, customer commitment, social impact, and being the best lead us at all times. Aye has and always will work towards financial inclusion.