Financial inclusion is one of the cornerstones of why NBFCs are a must in India. Why? Well, in spite of the considerable number of national, state and regional banks, a large chunk of our 135.26 crore citizens continue to be left out of their ledgers.

The reasons for this are manyfold ranging from a lack of proper documentation on the end of the loan takers to gaps in the banking system that make it more difficult to onboard smaller customers. The cost of processing just one loan application alone can go up to a few thousand rupees. This prompts banks and traditional FIs to overlook the applications of people looking for smaller loans in favor of large loan takers. It boils down to simple math. The input required for each application is the same; the revenue generated , on the other hand, is directly proportional to the size of the loan.

AI and NBFCs

As per the MSME Ministry, India has 6.33 crore MSMEs, 6.30 crore of whom fall in the micro-enterprise category. With such high numbers, their importance to our country’s economy, job industry, and contribution to GDP is undeniable. By offering loans to this underserved sector, NBFCs like Aye enable them to scale their business, adapt to real-world challenges, and in some cases, keep their doors for business.

So, how is it that NBFCs are able to do what organized financial institutions traditionally haven’t?

While factors like a dedicated staff trained to work with MSMEs play an integral role, NBFCs that have embraced innovations in fintech with vigor have had the most success as MSME lenders.

As Tejamoy Ghosh, Head – Data Science and Artificial Intelligence, Aye Finance puts it, “The growing world of MSME lending is also deriving value from the advancements being made in AI.

Here’s where NBFCs come in. With better last-mile servicing capabilities and a higher ability to adapt to new technology, they are embracing AI and MI at a faster pace to reduce the cost of lending significantly.

They are using machine learning to make improved lending decisions in the absence of business documentation by consolidating data points from various social and demographic sources. This is allowing for a larger number of businesses, who traditionally have not been able to access funds from organized sources, to be brought into the inclusive folds of formal lending.”

Why AI

Often times when we say something has had a transformative effect, it isn’t always so. But with AI, we can truly back up this claim with substantial evidence. If you talk to anyone at an NBFC that embraces AI, you’ll hear about the ways in which it has helped employees right from the junior-most to the apex decision-makers.

Here are some of the benefits they’ll tell you about –

- Automated Workflow Loops – Due to the regularities in an NBFCs loan products, standardized applications, and the routine and repetitive nature of most queries, lending offers many opportunities for workflow loops to be automated. This way, the employees are freed from having to take care of routine processes, enabling them to focus more on the intellect and human-interaction driven parts of their role.

- Expedited Data Processing – Where AI helps automate existing processes, Machine Learning can help develop new ones. Let’s take data processing for instance. One of the most prevalent problems MSMEs face while approaching a bank for a loan is their lack of proper documentation. The way NBFCs combat this problem is by making sense of alternative data points like GST, Digital IndiaStack, spend habits and more. Aye’s use of cluster-based information has been a game-changer in MSME lending. By combining the availability of psychometrics, cluster-based information, and more with the ability of ML algorithms to compute huge amounts of data, Aye’s credit team is able to calculate the payback ability and intent of MSMEs effectively.

- A deeper understanding of customers – ML can also be used to better understand existing customers and reach new ones. This can be done by tracking leads with real-time updates, increasing awareness with tailored automated messages & emails, and ultimately, building long-lasting relationships with customers.

How We Say Aye to AI and ML

If you ask Tejamoy Ghosh about the future of the MSME lending sector, he will tell you, ‘Innovation is going to separates leaders from the rest in the MSME lending sector. With Artificial Intelligence and machine learning, key industry players have found a ground-breaking way of doing things quicker, faster, and more cost-effectively.’

At Aye, we have always been great fans of innovation. To be in an industry as dynamic and ever-changing as micro-financing, you have to be because if you don’t keep up, you simply fall behind.

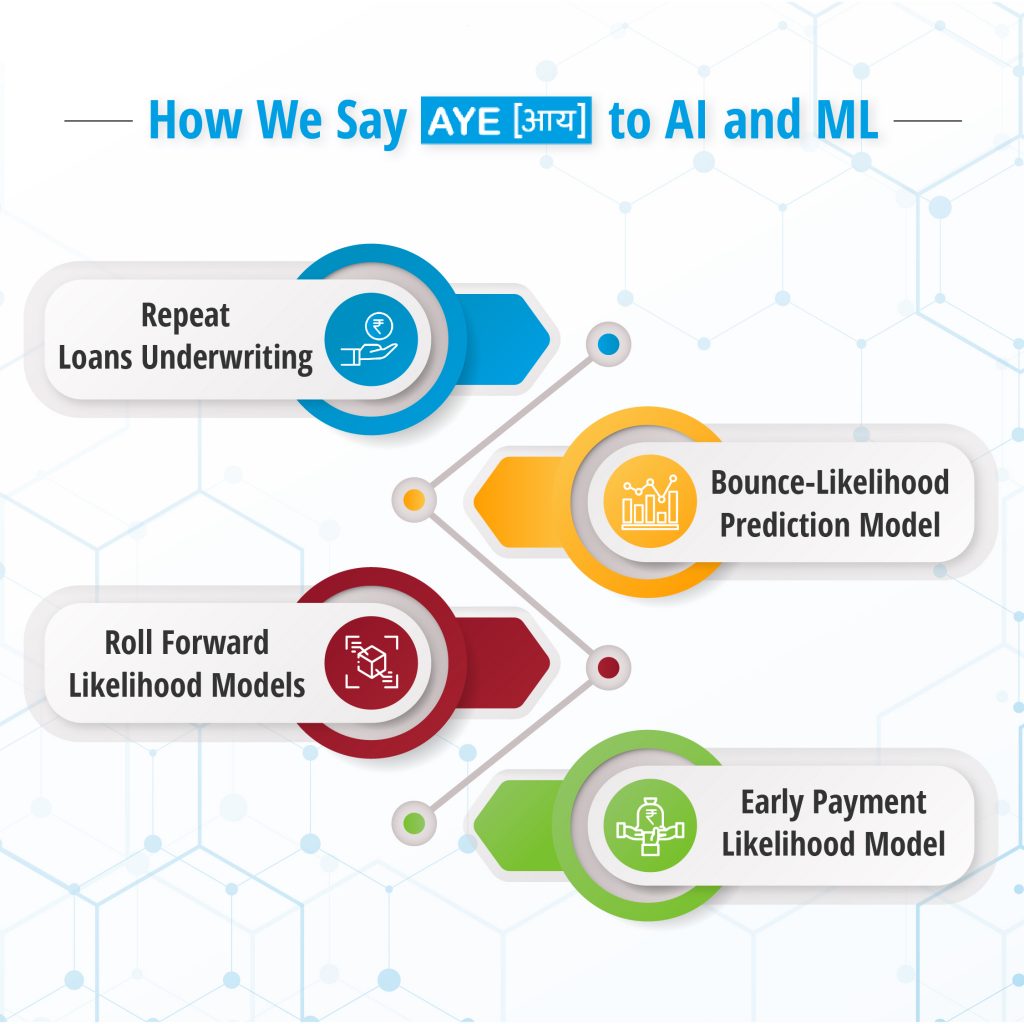

Here are some of our key DSAI projects –

- Repeat Loans Underwriting – At Aye, we pride ourselves on having customers who have gone through multiple loan cycles with us. One of the factors that make this possible is ML-powered repeat loans underwriting. By doing risk-based customer segmentation, we are able to create a pruning eligibility list and customize the loan amount basis the payback ability of each customer. Over time, this has resulted in a dramatic, yet sustainable, increase in repeat loan disbursements, a minimal number of early defaults, and an overall shift in our incremental portfolio to favor the lower side of the predicted default numbers.

- Bounce-Likelihood Prediction Model – One of the biggest problems plaguing NBFCs are high bounce rates. Using machine learning, we optimize our strategy for pre-EMI calling and allocate resources towards controlling bounce and maintaining a minimal and optimal bounce rate.

- Early Payment Likelihood and Roll Forward Likelihood Models – These two ML models go hand in hand helping us optimize our bounce collection calling strategies and allocate resources effectively to enhance the bounce collection process.

These machine learning models, and the way they have helped streamline our process both pre and post COVID-19, have been a true marker that AI and ML are integral when it comes to MSME lending. At Aye, the efficacy of our current models has already prompted us to start working on more DSAI projects. These range from processes to streamline the underwriting of new loans to models for the optimization of hard collection.

It’s time for all financial institutions to get on board the AI and ML train. If you’re still on the station unsure of whether or not to climb aboard, time’s running out. Right now, it’s an option, but very soon, it’s going to be an inescapable need. Tejamoy Ghosh, our head of DSAI sums it up well – “In times to come, innovating and adopting these technologies would no longer be a matter of choice and rather, will become a necessity in the ever-evolving business environment. Digital lenders should act fast and adopt these newer paradigms, in order to not only sustain their edge, but also make their services easily accessible to a staggering number of MSMEs requiring credit services.”