Aye Finance’s mission statement is “to provide innovative and customer-centered financial services to micro and small businesses through our knowledgeable team, effective technology, and robust processes, to power their growth into new-age India.”

At Aye Finance, maintaining customer satisfaction, and by extension, their loyalty has always been the focal point of all our policies and operations. For us, that has meant transparent processes, honest expectations, and open lines of communication – from day one.

With our primary target customers being micro and small enterprises in India’s Tier 2 and Tier 3 towns, we have always been steadfast in our conviction that we must provide the kind of support (both financial and non-financial) that banks cannot provide. Most of our clients are first-time borrowers who have never been fully inducted into the formal banking system. They have fairly low expectations when it comes to customer service. But we have never let that affect our approach to providing the most suitable products and services to our customers. We continue to follow a model of customer-driven, jargon-free financial assistance that amalgamates technology with a humane touch to provide the best in class customer service to the grassroot level businesses in India.

Whenever a new loan applicant comes into Aye’s branch, our branch staff and relationship officers try to make them feel comfortable by explaining all the features of the loan product and its benefits in a way that reassures them. An integral step to our disbursement process at Aye is to walk the customer through all the terms and conditions before they sign the official documents. This step happens once the documents are complete and the loan ready to be sanctioned. Even at this final stage of loan disbursement, ensuring absolute transparency is paramount and we let nothing get in the way of it.

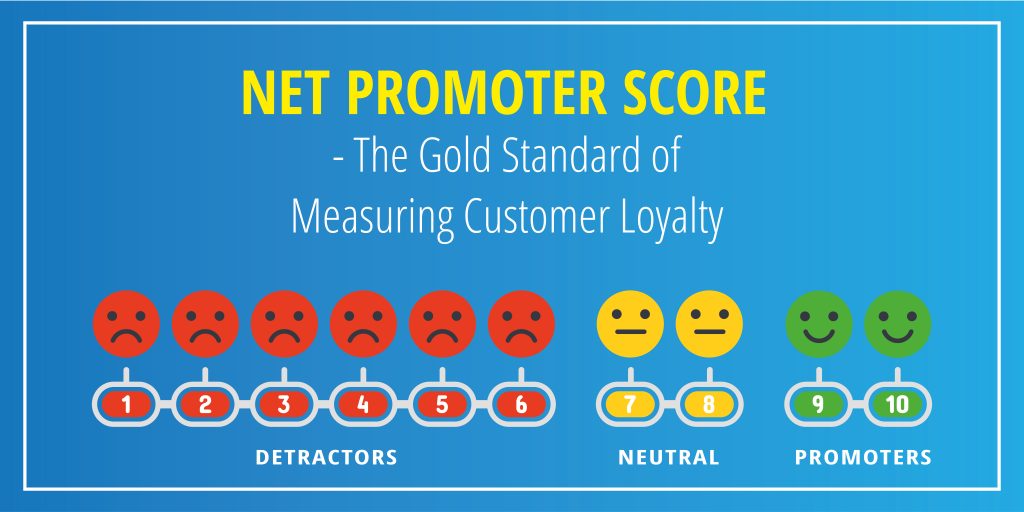

Net Promoter Score – The Gold Standard of Measuring Customer Loyalty

For any business to accurately gauge the success of their current model, one of the most effective parameters is asking one simple question – how many of our current customers actively recommend us to their peers? After all, whether or not your customers are willing to endorse your services speaks volumes for how loyal they are to your brand!

Seeing the soundness of this logic, Net Promoter Score, or NPS, was developed as a metric wherein customers are asked the following question – “How likely is it that you would recommend Aye to Friends or Family Members? Please rate on a scale of 0 to 10.” Only customers who award a company a score of 9 or 10 are counted as promoters, setting the bar quite high!

AYE and NPS – A Tale Of Success

With an NPS score in the high 70s, we at Aye pride ourselves on the success of our approach to achieving customer loyalty. But, obtaining one of the highest NPS scores across our industry has never been cause for us to become complacent. We believe that our NPS is just a measure of how much we can improve. Hence, by continuously analyzing our NPS, we keep evolving our products, services, policies, and staff training processes to better serve our customers.

A great way of using the NPS data to alter our service model is analyzing what demographics we have greater success with, and the ones we are falling short in. For instance, we recently noticed that our NPS score is higher in North India than it is in the South. Once this realization hit, we adopted a two-pronged approach to deciphering the root cause of the problem.

First, we evaluated the differences in how each branch approaches customer care and the steps we can take to emulate the success of our Northern branches in our Southern ones. Our second step, however, was the exact opposite. Once we understood the differences in their approaches, we set out to understand the similarities. After all, the same approach may not necessarily work for different people.

So, the question was, are the customer care processes that work well in the North not doing well in the South because of the differences in the sensibilities of the two regions? Once we found the answers to these questions, the next step was using the data to tailor our approach in the region. Over time, we will keep evaluating the success of the new model, and make tweaks wherever necessary.

By similarly understanding our NPS data across different verticals and asking ourselves the hard questions, it makes it possible for us to evolve our approach to best suit each and every one of our customers.

Our Happy Customers!

“I am very happy with the services of Aye Finance. The employees at the branch are courteous and treat me like a family member. I will definitely recommend Aye to my friends and relatives.”

- Sunita, customer near our Nasik branch

“I lost a lot of my cows 2 years back and my dairy business suffered huge losses. It was then that a friend told me about Aye Finance. I took a loan from Aye to buy 5 more cows, which helped re-establish my business. “

- Gurpal Singh, Dairy Farmer, Karnal

“I am very happy with Aye’s services and I have even referred Aye to my friends because of the quick service and response. Some of them have now also taken a loan from Aye.”

- Lalitha, customer near our Nellore branch

“There are many banks and NBFCs which provide repeat loans but they take some time. Aye’s services in comparison with them have been faster.”

- Vijay Lakshmi, customer near our Nellore branch

“The services of Aye are much better and faster than other companies, even though others might have a lower ROI than Aye.”

- Radha, customer near our Nellore branch

Every customer is equally important to us, and their personal success is something we take very seriously. Hence, when we have customers who come back to Aye time and time again for repeat loan cycles, we know we’re doing it right!